After the Trump report on tariffs in Europe where it affected steel, aluminum also failed to negatively affect the copper market as its demand is steadily declining.

A reason for declining demand and increasing reserve available is North America copper mines, increased sales by 2.4% per annum to 384 million pounds, Freeport expects sales of copper from North America to reach 1, 5 billion pounds in 2018.

Similarly, in South America, copper sales declined by 6.1% compared to the previous quarter. Freeport also expects a £ 1.2 billion increase in sales to be announced in 2018.

Still in Indonesia, copper sales rose by £ 319 million, compared to the previous quarter at £ 125 million.

With the increase in mining, the price of copper is justifiably reduced and the market is getting more and more heavy.

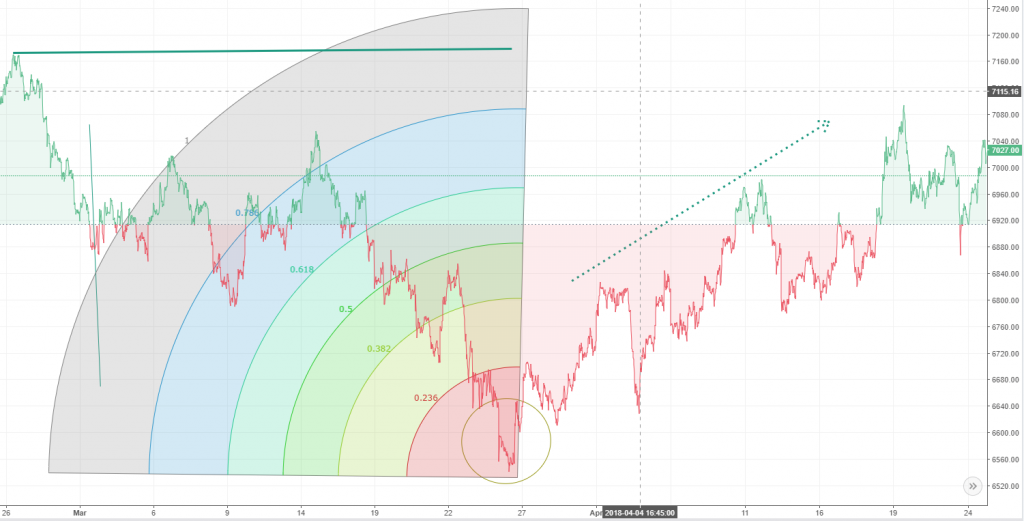

Practically this is as follows: From March to 16/3/18, the index declined, but daily at the closure of the sessions it was corrected. From 16 to 26/3/18 the index declined steadily with the price being at $ 6551 per tonne. In those days, up to the twenty-eighth of March, the reserve available was rising. This increase is recording an increase of 18%.

At the beginning of April, the red metal is on the rise and continuously decreasing the reserve, which is characterized as a possible sale on the markets. The index value is recorded in the metal table at $ 6986.75 per tonne, with its rise from early April at 3.7%.